Alternative Fundraising Websites for Small Businesses - Sun and Planets Spirituality AYINRIN

For Spiritual Consultations, Spiritual divination reading, Guidance and Counseling, spiritual products and spiritual Services, offering of Spiritual Declarations , call or text Palace and Temple Phone and Whatsapp contact: +2348166343145, Phone And WhatsApp Contact : +2347019686274 ,Mail: obanifa87@gmail.com, Facebook page: Sun Spirituality.Website:www.sunspirituality.com.

Our Sun spiritual Temple deliver Spiritual Services to Companies owners, CEOs, Business brands owners, Bankers, Technologists, Monarchs, Military officers, Entrepreneurs, Top Hierarchy State Politicians, and any Public figures across the planet.

Author:His Magnificence the Crown, Kabiesi Ebo Afin! Oloja Elejio Oba Olofin Pele Joshua Obasa De Medici Osangangan Broadaylight.

If you’re trying to get your small business off the ground, it can seem like one obstacle after another stands in your way — especially when you’re dealing with getting the financial part of your business straightened out. Wondering how to raise money to start a business? One option you might turn to is crowdfunding.

Crowdfunding is a unique option available to small business owners who are looking for extra capital to make their business vision a reality. In fact, it’s such a popular platform for raising money that there are currently 191 active crowdfunding sites as of this writing, and the crowdfunding industry as a whole is expected to surpass $300 by 2025.

When you think of crowdfunding, one of the names that immediately pops into your head is probably GoFundMe. The site is practically synonymous with online fundraising. However, GoFundMe may not be the best avenue for your small business to generate capital.

There’s a reason why there’s a “me” in the name, after all: it’s a platform geared toward personal causes. Businesses aren’t specifically barred from using it — usually, companies use it to fund smaller projects such as replacing old equipment.

With this information in mind, let’s dive into the details of crowdfunding, including the pros and cons of different platforms. There are plenty of GoFundMe alternatives to choose from. It just takes a little time and research to figure out the site that will best fit your company and your goals.

What are the Benefits of Crowdfunding?

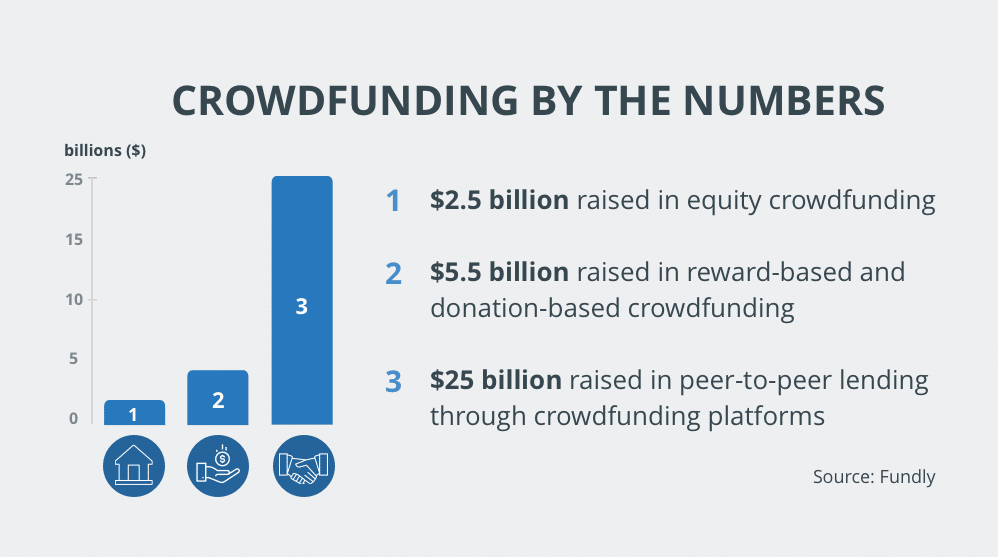

Don’t think crowdfunding has much of an impact? Think again. Fundly has some mind-blowing statistics that show just how much money crowdfunding has raised throughout its history.

Crowdfunding by the numbers:

- $5.5 billion raised in reward-based and donation-based crowdfunding

- $2.5 billion raised in equity crowdfunding

- $25 billion raised in peer-to-peer lending through crowdfunding platforms

One major benefit of crowdfunding is that you’re relying on a smaller network of people and investors instead of traditional financial institutions, which is a serious boon to new companies that aren’t quite big enough for formal avenues of funding like angel investors and banking institutions.

Even if you do have financial backing, crowdfunding can still be beneficial to your business. Why? Because it drums up excitement, anticipation, and emotional investment. Crowdfunding allows donors to be invested in your brand and your brand’s success in every sense of the word. Those who donate or give to a campaign are elevated on a higher platform than just a “consumer” — they’re an investor.

In addition, because of the social aspects of crowdfunding sites, you can build a community around your product or service. Once you get to your crowdfunding goal, you’re already tapped into a ready-made base of potential customers.

But before you reap the benefits of crowdfunding, how do you go about starting your own campaign?

Basic Steps to Crowdfunding Campaign Creation

If you’ve decided you want to go down the road of crowdfunding with an alternative to GoFundMe, there are some steps you should keep in mind as you progress. A successful funding campaign can be the way you generate dependable revenue for your business, but it must be done correctly.

Remember, with a crowdfunding campaign, you’re pitching to a ton of prospects all at once — except virtually, rather than through an in-person elevator pitch. Here are some tips you should take before diving into a campaign.

1. Research

You might get lucky and strike gold with your fundraising campaign, but what will increase your luck? Preparedness.

Take some time before starting your campaign — we’re talking at least two weeks out — and research the market, crowdfunding sites, and general fundraising advice. This is especially important if you’ve never done a fundraiser before. Choose a fundraising platform that matches your business goals (we’ll circle back to your available options below).

Crowdfunding doesn’t always offer instant results. Half of global crowdfunding campaigns are successful; if you want to put yourself in the success column, this research component is invaluable.

Look for examples of other companies that used GoFundMe alternatives and were successful in reaching their fundraising goals. What worked well for them? You should also think about if you want to organize a special, real-life event to kick off your fundraising.

2. Ask for Contributions ASAP

Don’t just set up your fundraising campaign and do nothing. It’s very rare that a complete stranger happens upon your campaign. On the day you start your fundraising, actively promote your crowdfunding link over social media platforms.

Tips to promote your campaign:

- Social media: Leverage the influence and reach of your friends, families, and community members.

- Customers: Reach out to existing customers who already use your services.

Send emails to your fundraising network in advance of your crowdfunding campaign, the day before, and the morning of your launch. For your close friends, send texts with the campaign link once it goes live. Most platforms have sharing tools integrated directly into the platform, making it easy for people to share your fundraising link and to spread the word.

3. Don’t be Vague and Keep Your Copy Spicy

You need to deliver as specific information as possible to possible donors. Nobody wants to support someone who is raising money to just “start a business.” Tell contributors what each amount helps you achieve, whether an extra thousand dollars means you can get much-needed equipment or add another vehicle to your fleet.

Information in the form of articles and videos are good ideas to integrate into your fundraising site. Lay out the information in an easy-to-digest way using bullets, headers, and paragraphs that are a maximum of three to four sentences.

Create a unique, attention-grabbing brand story:

- Keep it concise: People don’t want to read your autobiography.

- Give people context: How are you different than others?

- Provide timely updates: This will help investors stay engaged.

4. Swag is Never a Bad Idea

Donors and investors don’t necessarily expect anything in return when they’re giving you money (unless they’re guaranteed equity or another incentive). However, that doesn’t mean they would turn down an incentive.

For example, think about company T-shirts, caps, and hats if you’re trying to secure more funds for your business. Just keep the costs low otherwise you’ll be eating into your crowdfunding efforts.

5. Give Updates

While it would be great if you could just leave your crowdfunding site alone after you set it up, that’s not quite the case. You should be giving your donors scheduled updates about your fundraising progress. It shows you’re actively engaged and the campaign gains relevancy. It also keeps people excited and can show contributors where their money has already gone.

Be as engaged as you possibly can. If the GoFundMe alternative you decide on allows interaction with donors, be generous with your thank-yous and respond to questions. It benefits you to be as transparent as possible during the crowdfunding process to build trust and credibility.

Pros and Cons of GoFundMe

Now that you have an idea of why crowdfunding can specifically help your small business, what platform should you use? As we mentioned before, GoFundMe is one of the biggest crowdfunding websites in the market. However, in terms of business success, you might hit a few obstacles.

Usually, this site is used for personal emergencies and causes like paying for unexpected medical expenses and vet bills, or raising money for sports teams or charitable projects. Businesses do use the website, but typically, the amounts they’re aiming to raise are smaller and for single-use purposes. So if you’re trying to get your small business off the ground, GoFundMe might not be the right site for you.

Let’s look at a few of the pros and cons of GoFundMe.

Pros:

- No deadlines or goal limits

- 5-minute tech support guarantee

- Optimized for sharing on social media channels

- Mobile-optimized

Cons:

- Fees up to 8% on each donation

- Facebook account required for sign-up

- Tailored to personal causes

- Fees for maintenance

- 5-7 business days for fundraising proceeds to be processed and accessed

For many small businesses, GoFundMe’s drawbacks are too much to overcome. If you’re trying to determine how to raise money for your small business without taking the traditional financing route, don’t fear. There are plenty of sites like GoFundMe that are better suited for your specific needs.

GoFundMe Alternatives

Looking for seed funding? Need credit but you’re too small so banks won’t loan to you? Want to pre-sell your product before it goes mainstream? One-on-one mentoring to develop your crowdfunding campaign? The GoFundMe alternatives below cover those questions, plus many more. The GoFundMe competitors in this list are full of unique, business-oriented features that may help you get the money you need to launch.

Kickstarter

One of the largest and most well-known crowdfunding sites, Kickstarter, has been helping people raise money for their causes and projects for almost ten years. Because it’s such a large crowdfunding site, it’s very competitive and therefore, difficult to get featured. This is a major drawback for young companies trying to compete with other companies that start out with larger advertising budgets and can “out-promote” other businesses.

Pros:

- Campaigns in over 6 countries

- More than 15 million campaign funders

- Only 2.9% payment fees

Cons:

- Difficult to get campaign accepted

- 1 in 3 success rate

- All-or-nothing funding system; if you don’t hit your funding goal, you’re out of luck

Kickstarter is oriented around products, so if your business doesn’t have a main product and is instead service-based, it might not be for you. However, there are plenty of fundraising sites that raise funds for people with other types of businesses. Keep scrolling to read more.

Housecall Pro

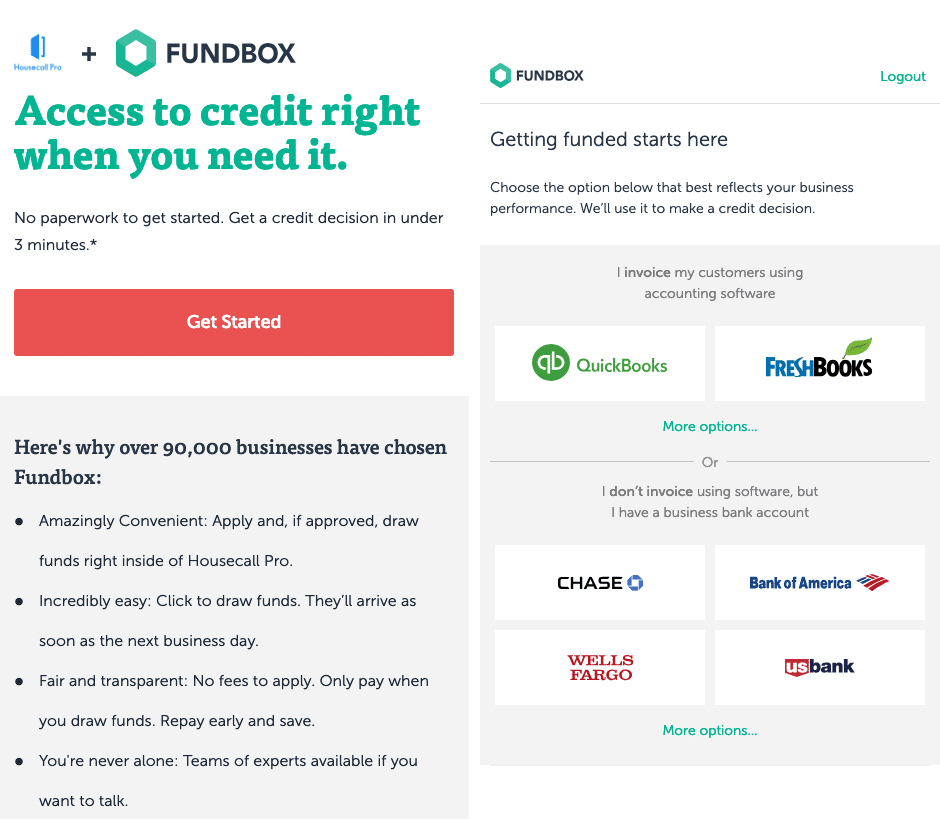

In the service industry? Housecall Pro has a creative solution for your small business funding needs called Fundbox. As a small business owner, it’s important to always work toward growing your company whether that means increasing clients, adding on more employees, or beefing up your services.

With that said, there are obstacles that get in the way of your growth at times. Unplanned expenses, repairs due to weather damage, or late invoice payments can lead to financial struggles.

That’s where Fundbox comes in. It’s a short-term credit solution that allows your business to stay afloat, even when trouble arises.

Features:

- Instant setup: Immediately connect your business bank account and get approved in minutes

- Quick access to funds: Once you’ve been approved, the proceeds you need will be available for you to use as soon as the next business day

- Save money: If you pay your loan back early, you can get the remaining fees waived

- Transparent costs: You’ll pay a simple flat fee for the weeks where you need it

Housecall Pro has an approval process in order for your business to use Fundbox which includes a business health assessment based on your company’s financial reporting. Once Housecall Pro has the information it needs, you’ll find out what amount you’ll be approved for and what your limit will be.

There aren’t any subscription costs for Fundbox and fees begin at just 4.66% of the amount you withdrew. While your fees may vary, you’ll know exactly the amount you have to pay before you take any money out.

Fundify

Fundify is a unique GoFundMe alternative focused on startups that need professional guidance. How, exactly? Fundify pairs up new companies with industry veterans and accredited investors. Startup businesses that have the right investors helping them along the way are three times more likely to succeed.

The best part? There are no costs to you as a business or to the investors that are part of the process.

Pros:

- No cost

- Simple set-up

- No hassle – simply email your company materials, and Fundify does everything else

Cons:

- Competitive to get accepted

iFund Women

Named by NASDAQ as one of the “10 Best Sources of Funding for Women Entrepreneurs,” iFundWomen offers female-led companies a variety of crowdfunding opportunities plus crowdfunding coaching, professional video production, and a private community for you to connect with other female entrepreneurs both inside and outside your industry.

Pros:

- Flexible funding:

- Keep whatever you raise, even if you don’t hit your goal

- Allows you to keep any money to help get your product and business off the ground

- Seed funding for your business and a funder tracking your success

- Mentoring for companies that need guidance

- A “Coaches Playbook” to help you map out your campaign, rewards, and crowdfunding goals

Cons:

- Funders will expect business results, even if you don’t hit your goal

Costs:

- iFundWomen takes a 5% fee on the funds you raise

- Credit card fees: 2.9% plus 30 cents per transactions

- Income taxes: varies based on the business and how much is raised

Although this platform is geared toward helping women breathe life into their businesses and products, you can also apply to crowdfund on the site as a male-founded company.

Circle Up

CircleUp aims to help small businesses in the crowdfunding world who are too small for private equity firms and not ready for a regular bank loan.

Pros:

- Offers equity capital through CircleUp Funds (investors take part-ownership in exchange for use of their funds)

- Offers credit financing through CircleUp Credit Advisors

- Loans from $20k to $3M

- Lines of credit up $3 million

Cons:

- Only a very limited number of companies are accepted on the site

- If your minimum fundraising goal isn’t met, the money is returned to investors

IndieGoGo

Since 2008, IndieGoGo has been a leading industry name in the startup crowdfunding market. More than 800,000 ideas have been put into production since the company’s inception. In addition, a total of $1 billion has been raised in a range of industries.

Pros:

- Two fundraising options:

- Fixed funding: all proceeds returned if you don’t hit your minimum goal

- Flexible funding: keep all of your funds even if you don’t hit your goal

Cons:

- Even if you don’t meet your fundraising goal, you still have to ship out the agreed-upon perks and rewards to contributors

- Smaller fundraising community than bigger sites like Kickstarter

Costs:

- Pre-launch is free

- 5% platform fee

- 3% plus 30 cents for each credit card transaction

Republic

If you’re wondering how to raise money for your small business, you might want to take a look at Republic. Republic is a GoFundMe alternative that gives startups access to funds on its streamlined fundraising site. Instead of cash, you use equity crowdfunding, which allows you to align your goals with customers. Because contributors get part ownership of your company, they are more invested — no pun intended — in the success of your company.

Republic was built to take the guesswork out of crowdfunding; you don’t even need legal counsel to get started. It boasts an impressive 95% success rate for funding startups.

Pros:

- Easy to use:

- Create a branded campaign page, accept investments via credit cards, ACH and wires

- Use messaging and notification tools to keep investors and potential investors engaged

- Use campaign management and analytics to optimize your entire crowdfunding process from start to finish

Cons:

- Higher initial cost and ongoing cost than other crowdfunding platforms

- The higher cost or unexpected costs of this platform may affect how to you predict your bottom line

- Equity funding means you’re losing small portions of ownership in your company

Costs:

- Companies only pay fees if they reach funding goal

- 6% of total funds raised in cash

- Form C: $1,5000 for disclosure forms

- Escrow: about $1,500, all campaigns need an escrow agent

- Other potential costs: $1,000-$4,000 for related financial expenses

- Attorney review: $0-$3,500 if in-house counsel or Republic reviews

- Credit card transactions: around 3.5%

SeedInvest

SeedInvest is a startup investing platform built by an expert group of investment professionals who helped pass the 2012 JOBS Act. This fundraising site boasts impressive stats. There are a total of 257,768 investors, over $100 million raised, and more than 150 startups have been funded since the site’s inception.

Pros:

- Simple set-up

- Get access to a network of accredited investors from around the world

- Host virtual fundraising sessions from wherever you happen to be

- Streamline everything from pitches to investors and legal document processing

Cons:

- Only about 1% of startups that apply end up getting funding

- Minimum investments of $500 (typically 50 times lower than other startup investments)

- Must pass a due diligence process to be accepted

- There are minimum requirements for companies to apply:

- At least a minimum viable product or prototype

- Proof of concept

- At least 2 full-time team members

- A US incorporated business

Costs:

- 5% placement fee, charges on the total amount raised if funding is successful

- 5% warrant coverage or equity

- $0-10,000 in due diligence, escrow, marketing, and legal expense reimbursements

Which Crowdfunding Option is Right for You?

Starting a small business is no small task. You have to draft a business plan, find employees, do market research, secure funding — the list could go on and on. One of the most crucial parts of building your company is getting the capital that actually allows you to grow.

Crowdfunding can be a lucrative platform you can use to your advantage, but it’s not a guaranteed source of proceeds. In order to make the most of your fundraising campaign on sites like GoFundMe, you’ll have to spend time (and money) preparing to build brand awareness and excitement. In addition, while the campaign is live, you’ll need to stay engaged to attract new investors and keep existing investors engaged.

If you’re looking for the best crowdfunding sites for startups, use these suggestions as a guide to get you started. A great crowdfunding campaign can help you make the next big move with your company — so you can then leave the competition in the dust.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.